Summary of Oracle General Ledger Setup and Management

Introduction The Oracle General Ledger (GL) module is a core component of Oracle’s financial management software, enabling organizations to manage and automate their financial processes. This guide provides an overview of setting up Oracle General Ledger, including essential configurations such as calendars, currencies, exchange rates, chart of accounts, and other critical setups for effective financial management.

Calendar and Currency Setup

Calendar: The calendar setup is crucial in Oracle GL, defining the fiscal periods for transactions. Configuring the calendar correctly ensures that financial data aligns with the organization’s reporting periods.

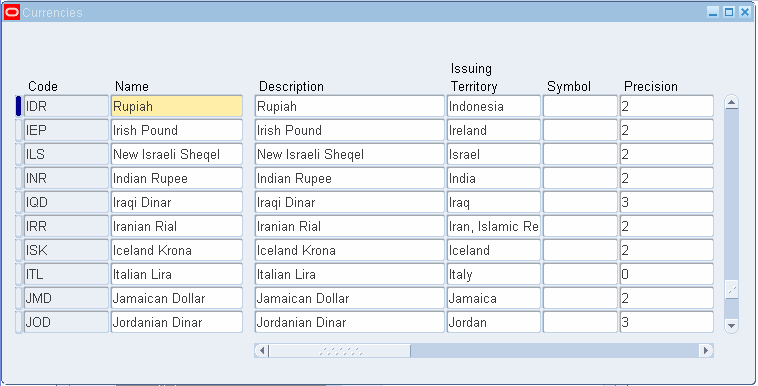

Currency: The currency setup defines the default currency for transactions within the GL. Organizations can configure multiple currencies to support global operations, enabling transactions in various currencies while maintaining accurate financial reporting.

Defining Exchange Rates: Setting up exchange rates is vital for converting foreign currency transactions into the base currency. Oracle GL allows defining daily, periodic, and historical exchange rates, providing flexibility for financial operations.

Chart of Accounts and Account Aliases

Chart of Accounts (COA): The COA is a critical structure that defines how financial transactions are recorded and reported. It involves setting up segments, values, and validation rules that align with the organization’s financial reporting needs. Properly defining the COA ensures accurate financial data capture and reporting.

Account Aliases: Account aliases simplify data entry by allowing users to enter a predefined alias instead of the full account combination. This feature increases efficiency and reduces errors during journal entry.

Flexfield Value Security

Flexfield Value Security allows organizations to control access to specific segments or values within the chart of accounts. By defining security rules, organizations can ensure that only authorized users can enter or view specific account combinations, enhancing data security and compliance.

Journal Transactions

Manual Journals: Manual journal entries are the foundation of Oracle GL, allowing users to record financial transactions manually. The process includes entering account combinations, amounts, and additional details necessary for accurate financial reporting.

Recurring Journals: Recurring journals automate the entry of repetitive journal transactions. Oracle GL supports two types of recurring journals:

- Skeleton/Standard Recurring Journals: Used for transactions that occur regularly but with varying amounts.

- Formula-Based Recurring Journals: Allow the creation of journals based on specific calculations, automating complex transaction entries.

Generating Recurring Journals: After defining recurring journals, users can generate these journals periodically, ensuring that repetitive transactions are recorded efficiently and consistently.

Mass Allocation and Statistical Journals

Mass Allocation: Mass allocation allows for the automated distribution of costs, revenues, or other financial data across multiple accounts or departments based on predefined rules. This feature simplifies the allocation process, especially in large organizations with complex financial structures.

Statistical Journals: Statistical journals are used to record non-financial data, such as headcount or square footage, which can be used in conjunction with financial data for more detailed reporting and analysis.

Defining Mass Allocation Batch: The process involves setting up allocation rules and generating allocation journals, which can be reviewed and posted to the GL.

Reversal Journals and Auto Reversal Criteria

Reversal Journals: Reversal journals are used to reverse incorrect or temporary journal entries. Oracle GL allows for both manual and automatic reversal of journals, ensuring that financial data remains accurate and up-to-date.

Setting Up Auto Reversal Criteria: Auto reversal criteria can be defined for specific journal categories, automating the reversal process and reducing manual intervention.

Posting of Journals

Manual Adhoc Posting: Users can manually post journal entries to the GL, ensuring that transactions are recorded in real-time. This process is critical for maintaining up-to-date financial records.

Automatic Posting: Automatic posting can be configured to post journals automatically at specified intervals, reducing the need for manual intervention and ensuring timely financial reporting.

Importing and Correcting Journals

Importing Journals: Oracle GL supports the import of journals from external systems or other Oracle modules. This feature allows for the seamless integration of financial data across different platforms.

Correcting Imported Journals: After importing journals, users can review and correct any errors before posting them to the GL, ensuring the accuracy of financial data.

Foreign Currency Balances and Revaluation

Foreign Currency Balances Revaluation: Revaluation is the process of updating the value of foreign currency balances based on current exchange rates. This ensures that the financial statements reflect accurate currency values, especially in organizations with significant foreign currency transactions.

Revaluation Process: The revaluation process can be automated or manual, depending on the organization’s needs. It involves calculating the unrealized gains or losses due to currency fluctuations and updating the GL accordingly.

Translation and Consolidation

Translation: Translation is the process of converting financial statements from one currency to another, typically for the purpose of consolidation in multinational organizations. Oracle GL provides tools to automate this process, ensuring consistency across financial reports.

Consolidation Workbench: The Consolidation Workbench is a tool within Oracle GL that helps organizations consolidate financial data from multiple entities or subsidiaries. It provides a streamlined process for aggregating financial data and generating consolidated financial statements.

Global Consolidation System: The Global Consolidation System (GCS) in Oracle GL provides advanced features for managing complex consolidation processes, including intercompany eliminations and multi-currency translations.

State Controller and Consolidation Process Steps: The state controller and consolidation process steps ensure that all entities follow a consistent process for financial consolidation, reducing errors and improving efficiency.

Close Accounting Cycle

Period Closing: Closing the accounting period is a critical process in Oracle GL, ensuring that all transactions for the period are recorded and reported accurately. This involves reviewing and reconciling accounts, posting all journals, and generating final financial reports.

Year Closing: Year-end closing in Oracle Applications involves rolling over balances to the next fiscal year, ensuring that financial data is carried forward accurately. This process includes closing out income statement accounts and carrying forward balance sheet accounts.

Reporting and Inquiry

Standard Reports: Oracle GL provides a range of standard reports that help users analyze financial data, including balance sheets, income statements, and cash flow statements. These reports can be customized to meet specific organizational needs.

Viewing Account Balances: Users can view account balances in real-time, providing insights into the organization’s financial position at any given time. This feature supports better financial decision-making and reporting.

Share to Others